Smart Property Investment: Best Ideas in the U.S. Market

Property investment in the United States continues to attract both new and experienced investors. Despite market fluctuations, U.S. real estate remains one of the most reliable ways to build long-term wealth. The key lies in choosing smart investment ideas that match current market trends, location demand, and future growth potential.

This guide explores the best property investment ideas in the U.S. market, helping you make informed and strategic decisions.

Why the U.S. Property Market Still Attracts Investors

The U.S. real estate market offers:

- Strong legal protection for property owners

- A wide range of investment options

- High rental demand in major cities

- Long-term appreciation potential

Population growth, job opportunities, and urban development continue to fuel housing demand across many states.

Best Smart Property Investment Ideas in the U.S.

1. Rental Properties in Growing Cities

Investing in rental homes remains one of the most popular strategies. Cities with expanding job markets and rising populations offer steady rental income.

Best options include:

- Single-family homes in suburban areas

- Apartments near business districts

- Properties close to universities and hospitals

Rental properties provide monthly cash flow along with long-term value appreciation.

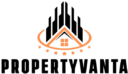

2. Multifamily Properties for Stable Returns

Multifamily properties such as duplexes, triplexes, and apartment buildings are ideal for investors seeking stable income.

Why they work:

- Multiple rental units reduce vacancy risk

- Higher overall rental income

- Easier property management under one roof

This option is especially popular in urban and semi-urban U.S. markets.

3. Short-Term Rentals in Tourist Destinations

Short-term rentals have gained popularity due to travel demand. Properties in tourist-friendly cities can generate higher income compared to traditional rentals.

Ideal locations include:

- Beach destinations

- Major entertainment hubs

- Historic and cultural cities

Success depends on local regulations, seasonal demand, and professional property management.

4. Commercial Real Estate Opportunities

Commercial properties such as offices, retail spaces, and warehouses offer long lease terms and potentially higher returns.

Key benefits:

- Reliable tenants with long contracts

- Lower tenant turnover

- Strong income stability

This investment suits investors with higher capital and a long-term vision.

5. Real Estate Investment Trusts (REITs)

For those who prefer a low-maintenance approach, REITs offer exposure to U.S. real estate without owning physical property.

Advantages of REITs:

- Easy entry with lower investment

- Regular dividend income

- High liquidity compared to physical property

REITs are ideal for beginners or investors seeking diversification.

6. Fix-and-Flip Properties

Buying undervalued properties, renovating them, and selling for profit is another smart strategy.

Best suited for:

- Experienced investors

- Markets with high buyer demand

- Areas undergoing redevelopment

This strategy requires market knowledge, cost control, and timing.

Key Factors to Consider Before Investing

Before choosing any property investment idea, evaluate:

- Location growth potential

- Rental demand and vacancy rates

- Property taxes and maintenance costs

- Local laws and regulations

- Market trends and interest rates

A well-researched investment reduces risk and increases profitability.

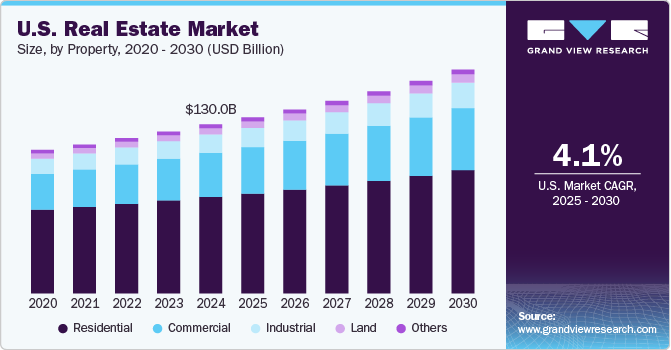

Future Outlook of U.S. Property Investment

The U.S. property market continues to evolve with changing lifestyles, remote work trends, and technology adoption. Investors who focus on data-driven decisions, strong locations, and long-term planning are more likely to succeed.

Smart property investment is not about quick gains—it’s about consistent growth, income stability, and future security.

This content is intended for informational and educational purposes only. It does not constitute financial, legal, or investment advice. Property investment involves risk, and market conditions may vary. Readers are advised to consult with qualified real estate or financial professionals and verify information from official sources before making any investment decisions.

#PropertyInvestment #USRealEstate #RealEstateInvesting #SmartInvesting #Carrerbook #Anslation #WealthBuilding #RentalIncome #REITs #USHousingMarket #InvestmentIdeas #FinancialGrowth